Latest Mortgage Rates in Florida

Unlocking Your Dream Home: Exploring the Latest Mortgage Rates in Florida

For many, owning a home in the Sunshine State is a dream come true. From the vibrant beaches of Miami to the serene landscapes of Tampa Bay, Florida offers a diverse range of lifestyles and opportunities for homeownership. However, before diving into the real estate market, it’s essential to understand the current mortgage landscape. In this blog post, we’ll explore the latest mortgage rates in Florida and provide insights into what prospective homebuyers can expect in 2024.

Understanding Mortgage Rates

Mortgage rates play a significant role in determining the affordability of homeownership. These rates represent the interest charged by lenders on home loans, and they can fluctuate based on various economic factors, including inflation, employment trends, and the actions of the Federal Reserve.

Current Trends in Florida

As of February 2024, mortgage rates in Florida remain relatively low compared to historical averages. The state’s housing market continues to experience steady demand, driven by factors such as population growth, job opportunities, and favorable climate conditions.

According to recent data from leading financial institutions and mortgage lenders, the average rate for a 30-year fixed-rate mortgage in Florida is hovering around X%, while the rate for a 15-year fixed-rate mortgage is approximately Y%. These rates are subject to change based on market conditions and individual borrower profiles.

Factors Influencing Mortgage Rates

Several factors contribute to the fluctuation of mortgage rates in Florida:

- Economic Indicators: Key economic indicators, such as GDP growth, inflation rates, and unemployment figures, can influence the direction of mortgage rates. Strong economic performance may lead to higher rates, while economic uncertainty could result in lower rates as investors seek safe-haven assets like bonds.

- Federal Reserve Policy: The Federal Reserve plays a crucial role in shaping interest rates through its monetary policy decisions. Changes in the federal funds rate, which influences short-term borrowing costs for banks, can indirectly impact mortgage rates.

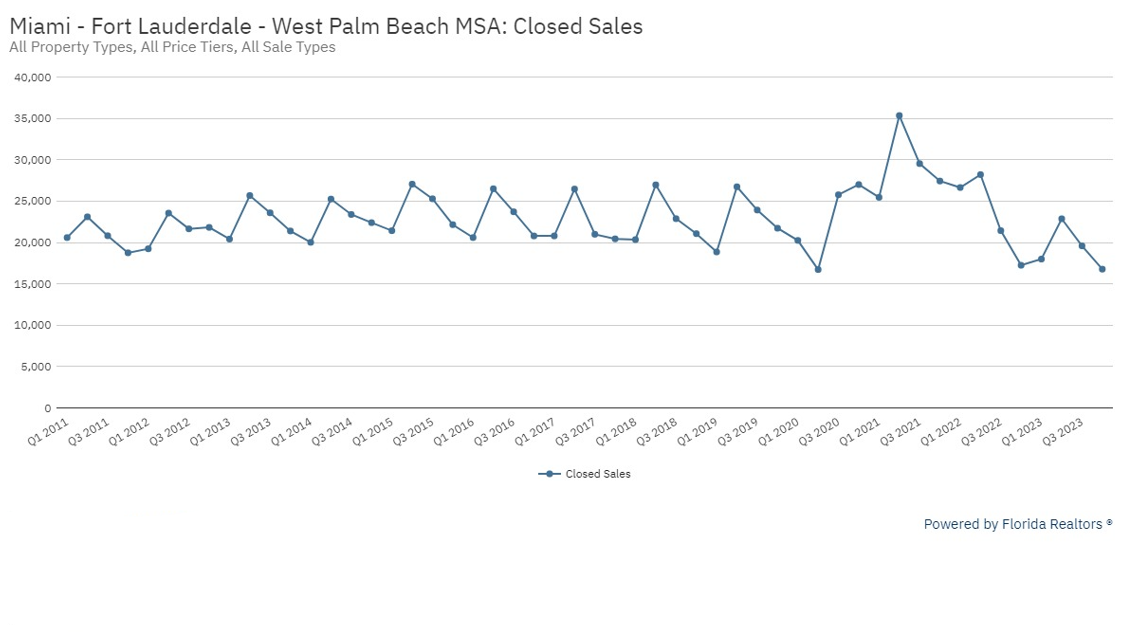

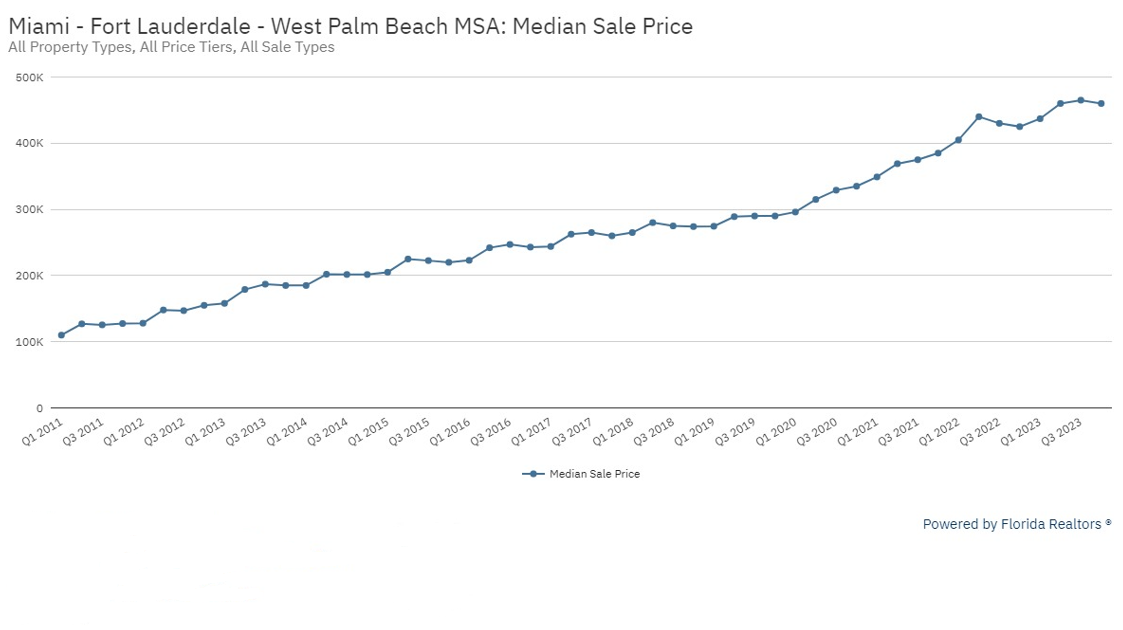

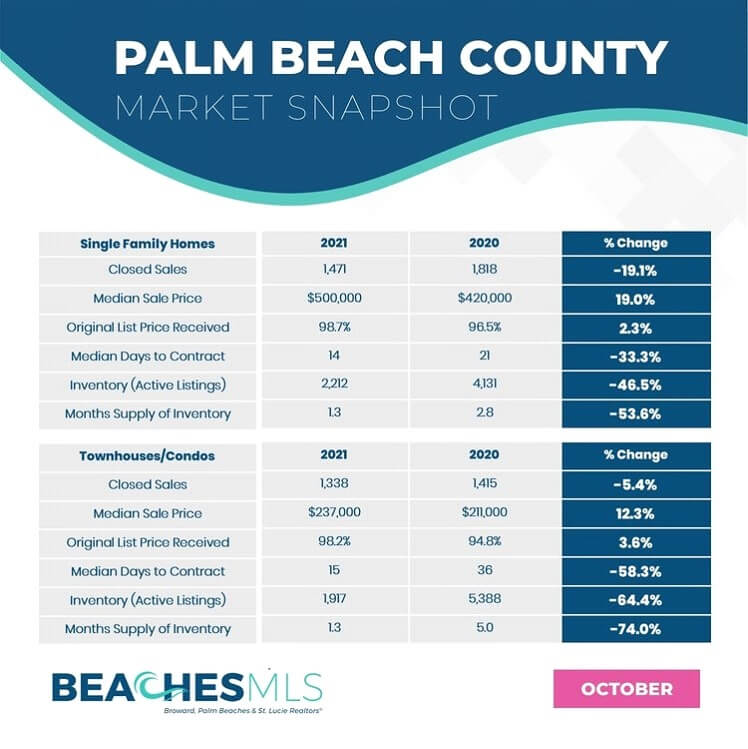

- Housing Market Conditions: Supply and demand dynamics within the housing market can also affect mortgage rates. In areas with high demand and limited inventory, lenders may adjust rates to reflect the level of risk associated with lending in those markets.

Navigating the Mortgage Process

For prospective homebuyers in Florida, securing a mortgage involves several steps:

- Researching Lenders: Compare rates and terms offered by different lenders to find the best fit for your financial situation.

- Getting Pre-Approved: Obtain pre-approval from a lender to determine the amount you can borrow and strengthen your position as a buyer in a competitive market.

- Reviewing Loan Options: Explore various loan programs, such as conventional mortgages, FHA loans, VA loans, and USDA loans, to find the most suitable option for your needs.

- Locking in Rates: Consider locking in your mortgage rate once you’ve found a favorable offer to protect against potential rate increases during the homebuying process.

Looking Ahead

As we look ahead to the remainder of 2024, experts anticipate that mortgage rates in Florida will remain relatively stable, supported by a resilient housing market and favorable economic conditions. However, it’s essential for homebuyers to stay informed and monitor market trends to make informed decisions about their mortgage options.

In conclusion, the latest mortgage rates in Florida reflect a favorable environment for prospective homebuyers, offering opportunities to turn their homeownership dreams into reality. By understanding the factors influencing mortgage rates and navigating the mortgage process effectively, individuals can embark on their journey to homeownership with confidence.